Dame Margaret Hodge

Sharethis specific contribution

I thank Mr Speaker for granting this debate and the Minister for joining us. I also thank a host of civil society experts who have helped me—too many to name—but I give special thanks to Professor John Heathershaw of Exeter University, Adam Hug of the Foreign Policy Centre and Sue Hawley of Spotlight on Corruption.

Earlier this week, the Foreign Secretary announced welcome moves to toughen up the sanctions regime against Russia, but we should not be waiting for a potential military crisis before we act against illicit finance at home and corruption overseas. We should act and use the powers we have now.

Today, I want to shine a light on foreign corruption in another state, not simply because that is important in itself, but because I want to highlight the UK’s role in facilitating shameful wrongdoing. Put simply, Britain enables kleptocracy. My ask of the Government is twofold. First, they should act proactively by sanctioning wrongdoers in Kazakhstan. Secondly, now that they have committed to tabling an economic crime Bill in the next Session, they must ensure the Bill’s provisions are fit for purpose, tough, effective and appropriate so that Britain can show by what we do that we are seriously committed to fighting the scourge of dirty money.

It is 30 years since Kazakhstan, a multi-ethnic, resource-rich central Asian state, emerged from the disintegration of the Soviet Union. In those years, Kazakhstan has, by some indicators, been a success. Its GDP growth has outstripped that of many of its neighbours, including Russia. Living standards are higher and until the 2010s Kazakhstan appeared to enjoy political stability.

But there is another side to the Kazakhstan story. The country is ruled by a kleptocratic elite that has grown rich off the back of money stolen from its people. Until 2019, its autocratic dictator was Nursultan Nazarbayev. In Kazakhstan, just 162 people own 55% of the wealth—mostly members of Nazarbayev’s family or close associates. The country has a poor human rights record and little media freedom.

As early as 2006, Jonathan Winer, former Deputy Assistant Secretary of State for International Law Enforcement in the Clinton Administration, said:

“I can’t think of a leader in the free world as notoriously corrupt as Nazarbayev… We’ve know about his corruption for at least 15 years”.

Yet in Britain, we turned a blind eye, ignored the corruption and helped the Kazakh regime launder and spend its dirty money.

Three examples confirm my view. Between 2008 and 2015, we issued 205 Kazakh kleptocrats with golden visas to settle with their dirty money in the UK, which was the fifth most common country for users of the Tier 1 Investor scheme. A recent Chatham House report reveals that the Kazakh elite owns over half a billion pounds of property in the UK. Around £330 million of that belongs to Nazarbayev’s extended family, including Sunninghill Park, allegedly bought by Nazarbayev’s son-in-law for £15 million—£3 million over the asking Toggle showing location ofColumn 568price. The Organised Crime and Corruption Reporting Project has revealed how Nazarbayev secretly controls four charitable foundations with at least $7.8 billion-worth of assets, invested in everything from hotels to banks. This global fortune is part-owned through a UK listed holding company set up in 2020—Jusan Technologies.

We have opened our borders, our property market and our financial structures to the Kazakh ruling class, enabling them to launder their illicit wealth and spend it. Worse, we do not even enforce our existing laws against any of this wrongdoing.

Why does this matter now? Because the fault lines of the corrupt Kazakh political elite have exploded. Protests, initially triggered by the soaring costs of liquidised petroleum gas, quickly developed into a national movement against the governing regime. The response from the new President, Tokayev, allegedly handpicked for the job by Nazarbayev, was initially to distance himself from the old regime. He then requested support from Russia, which sent in troops. Finally, on 7 January, he deployed the military against the protesters, with a “shoot to kill without warning” order. Protesters, most of whom were peaceful citizens, were gunned down without so much as a warning shot. According to some experts, this shocking, violent suppression has left 225 dead, 4,500 injured and 10,000 arrested.

That terrible loss of life in Kazakhstan should lead to a moment of reflection for us in Britain. We are complicit in what is happening in Kazakhstan. Our lack of transparency over foreign property ownership, our lax regulatory regime and our weak enforcement agencies have all aided and abetted the Kazakh elite.

Yet it is not too late for us to act. The Government have put in place a new regime of anti-corruption sanctions to complement our Magnitsky sanctions. They allow us to designate foreign, corrupt actors, freeze their UK assets, stop them entering Britain and limit their access to our financial or legal enablers. Sanctions are powerful tools, but, Minister, they must be used. That is why the Government should impose sanctions on the Kazakh oligarchs, who have systematically robbed their people to line their own pockets. The recent violence demonstrates the true cost of kleptocracy. It is surely up to us, in the UK, the jurisdiction that has done so much to facilitate corruption in Kazakhstan, to act and hold these individuals to account.

Our all-party group on anti-corruption and responsible tax is co-operating with representatives from legislatures in Europe and America. We have formed the Inter-Parliamentary Alliance against Kleptocracy, and together we are urging Governments in the UK, the US and the EU to issue sanctions against the kleptocrats of Kazakhstan. Today, I am calling for action from the UK to designate anti-corruption sanctions against the following individuals, whom I shall name, all of whom are allegedly involved in asset seizure and bribery. The details I will provide are limited because of time, but every story is shocking.

There is Timur Kulibayev, his wife Dinаra Nazarbayeva —the daughter of Nazarbayev—and their associate Arvind Tiku. Evidence suggests that Kulibayev abused his position to accrue vast wealth. In 2020, the Financial Times showed that Kulibayev benefited from a secret scheme to divert profits from big state pipeline contracts. He has faced money laundering and bribery investigations Toggle showing location ofColumn 569in other jurisdictions. His worth, according to Forbes, is $2.9 billion, and he owns at least £60 million of real estate here in the UK.

There is Dariga Nazarbayeva and her rumoured husband Kairat Sharipbayev. Dariga is Nazarbayev’s eldest daughter. Her empire, estimated by Forbes at $595 million, is hidden in an incredibly complex system of offshore companies, foundations and trusts. Three of her London properties were subject to a failed unexplained wealth order, but investigators at Source Material allege that Nazarbayeva may have misled the UK High Court. Meanwhile, Sharipbayev is allegedly one of the beneficiaries of a $334 million fraud at Kazakh bank Bank RBK, which has been labelled

“the bank of the Nazarbayev family”.

There is Nurali Aliyev, son of Dariga and grandson of the former ruler. Aliyev was appointed deputy chairman of a private Kazakh bank called Nurbank—after the grandfather—at the age of 21, and chairman at 22. UK court documents show he received a $65 million loan from a bank in 2008, through a company which then made a further loan. According to Nurali’s lawyers, he used some of those funds to purchase a £39.5 million house in Bishops Avenue.

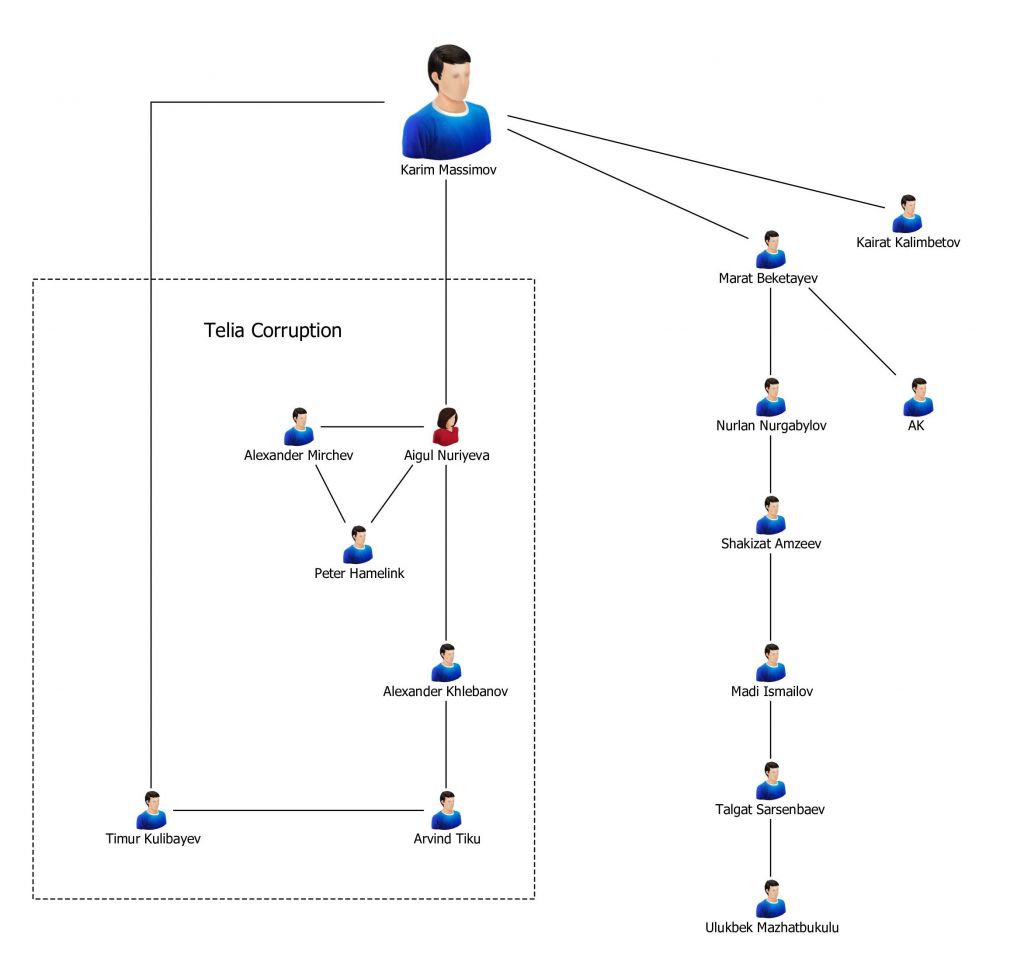

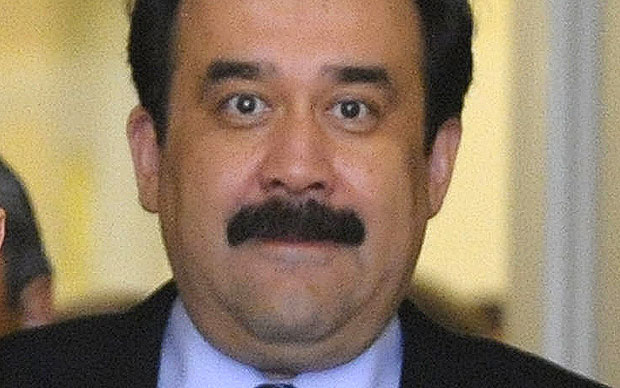

There is Karim Massimov, and his associate Aigul Nuriyeva. Massimov is a former Prime Minister of Kazakhstan who has been subject to bribery allegations, including from UK listed companies, as reported in the FT. He was also implicated in allegations of bribery by Airbus for the purchase of 45 helicopters. Nuriyeva is a Kazakh banker and alleged proxy for Massimov, who is himself implicated in major bribery scandals totalling $64 million with the Swedish telecoms company Teli.

Vladimir Kim is Kazakhstan’s richest man, worth some $4.3 billion. He chaired Kazakhmys plc, the first Kazakh company to list on the London Stock Exchange. A Global Witness report claimed that Kim acted as a proxy owner, and that Nazarbayev actually controlled the company. In 2017, Kim’s daughter Kamila, then 18, bought three flats worth $60 million in Knightsbridge. His associate, Eduard Ogay, is co-owner of Kazakhmys—sorry if I am pronouncing these names wrongly—and is alleged to have given bribes to the country’s Prime Minister.

Kenes Rakishev is a mysteriously wealthy Kazakh businessman worth up to $1.6 billion, with close ties to the political elite, and a close associate of the head of the Chechen Republic, who has been sanctioned by the US.

Sauat Mynbayev was Minister for energy and mineral resources, yet he secretly co-owned a Bermuda-based company worth $3 billion, which won public contracts in Kazakhstan despite the obvious conflicts of interest with his ministerial role. His wife and son own property in the UK.

Alexander Mashkevich, Patokh Chodiev and an associate who died were known as the “Trio”, renowned for their ownership of Eurasian Natural Resources Corporation, a Kazakh-based mining company also listed on the London Stock Exchange. In 2013, the Serious Fraud Office launched a criminal investigation into the company, following allegations of bribery to African political figures.Toggle showing location ofColumn 570

Bulat Utemuratov is a former chief of staff to Nazarbayev. A US diplomatic cable reported allegations that Utemuratov was the President’s “personal financial manager” and his own website assesses his personal wealth at $3.9 billion.

Bolat Nazarbayev is Nursultan Nazarbayev’s very wealthy brother. In 2008, he purchased a £20 million apartment in Manhattan’s ultra-exclusive Plaza Hotel. He is accused of involvement in armed groups that helped to spark the January violence.

Akhmetzhan Yesimov, chairman of the sovereign wealth fund, allegedly abused his position to give his former son-in-law, Galimzhan Yessenov, related party loans through secretive British Virgin Islands companies to buy a UK entity called Kazphosphate. Yessenov is now one of Kazakhstan’s richest men.

Kairat Boranbayev’s daughter married Nazarbayev’s grandson—it is all in the family. He held a number of positions, including one involved in the notoriously corrupt transit of gas from Turkmenistan. He owns a £25.4 million mansion in an exclusive gated community in Virginia Water, a £60 million flat in One Hyde Park, and three luxury apartments, worth more than £15 million, in Knightsbridge.

Then there is Alexander Klebanov and his son Yakov. Alexander has an estimated wealth of $374 million and chairs the Central Asian Electric Power Corporation. The two act as financial proxies for the former president’s family, and are thought to have helped Dariga Nazarbayeva to avoid the unexplained wealth order.

Nurlan Nigmatulin, Baurzhan Baibek and Marat Beketayev are senior figures in the ruling Nur Otan party and are close associates of Nazarbayev. They are embedded in supporting corruption and allegedly responsible for human rights abuses.

A UK High Court has highlighted how Aliya Nazarbayeva, Nazarbayev’s youngest daughter, moved over $300 million out of the country through complex offshore structures, including in the BVI. Aidan Karibzhanov is accused by his former wife of having profited from his position as a banker by selling the Kazakhstan national telecoms company and, I quote,

“privatization of public assets resulting in huge profits to politically connected insiders at the expense of the state”.

Kairat Satybaldy and Samat Abish are Nazarbayev’s nephews, enjoying significant wealth through offshore structures. Both are key players in Nazarbayev’s inner circle, involved in the current power struggle that is undermining peace and security.

I have named those people. Imposing sanctions on this corrupt elite will not of itself root out evil practices or lead to a radical democratic transformation in Kazakhstan, but it will demonstrate that we mean what we say when we commit to fighting dirty money and corruption. The cost of inaction is high. The reputation of London and our financial services sector is already sullied, with the UK seen as the jurisdiction of choice for dirty money. With swift action, we can begin to restore the idea of a good global Britain and demonstrate to our allies that we will not provide a safe haven for kleptocrats or oligarchs.

I ask the Minister whether he will consider the individuals I have named and impose sanctions on those who have stolen from their country, laundered their money here, used UK structures to hide their ill-gotten gains, used Toggle showing location ofColumn 571the golden visa route to gain entry to the UK or committed human rights abuses. Will he act now? Only by strengthening transparency, legislating for tougher regulations and ensuring consistent, strong enforcement will we be able to hold our heads up high again as a trusted jurisdiction that lives by the highest standards. We must finally turn the warm words of successive Governments into firm actions in the promised economic crime Bill. Will the Minister confirm that the Bill will be considered this year? If the Government fail yet again on these two fronts, the only ones who will be delighted are people such as the criminal kleptocrats from Kazakhstan who will be laughing all the way to the bank.

5.20pm

The Minister for the Middle East, North Africa and North America

(James Cleverly)

Sharethis specific contribution

I am grateful to the right hon. Member for Barking (Dame Margaret Hodge) for securing the debate and I pay tribute to the work that she has done on these complex issues both in her former role as a Select Committee Chair and as chair of the all-party group on anti-corruption and responsible tax. As my noble Friend Lord Ahmad, the Minister with responsibility for south and central Asia, is in the other place, it is my pleasure to respond on behalf of the Government.

This month, the UK celebrated 30 years of diplomatic relations with Kazakhstan, our largest partner in central Asia. Over the years, we have built a strong partnership in areas such as oil and gas investment, education and financial services, as well as promoting human rights and democratic values. We have had real success in encouraging a more open business environment in Kazakhstan, including through the Astana International Financial Centre.

Hon. Members—though few are here—will have witnessed the violent clashes that took place in January after initially peaceful protests in western Kazakhstan over increased fuel prices. As the right hon. Lady said, the latest estimates are that more than 200 people died during those clashes. There were reports of organised attacks on property and law enforcement officers, and almost 10,000 people were detained. I am sure that she will join me and others in roundly condemning the violence and loss of life.

My noble Friend Lord Ahmad has been engaged intensively on these issues, speaking to senior Kazakh contacts last month, including President Tokayev’s special representative on 14 January. In each of these calls, the Minister has underlined the importance of Kazakhstan respecting its international human rights commitments. President Tokayev has called what happened an “attempted coup” and we are urgently seeking further information about that very serious development. We welcome the President’s decision to establish an investigative commission to ascertain what led to these unprecedented events and loss of life. We support the Kazakh authorities’ commitment that this will be an effective and transparent investigation and have encouraged them to consider international and independent expertise.

In his public remarks, the President was clear that the original peaceful protests were based on legitimate grievances about the socioeconomic situation and that urgent economic reform is needed. We support that message and we seek opportunities, with our international partners, to support those reforms.Toggle showing location ofColumn 572

President Tokayev has also been critical of an existing social system that has seen economic growth largely benefit a small number of very rich people in society, as the right hon. Lady highlighted. We are well aware of reports on the alleged acquisition of assets by wealthy members of elite Kazakh society, including of substantial property holdings here in the UK. It is, of course, the role of law enforcement agencies to investigate any specific allegations of wrongdoing, as she said.

As a leading financial services centre, the UK can, unfortunately, be the destination for the proceeds of corruption, despite findings from the Financial Action Task Force that the UK has one of the strongest systems to combat money laundering and terrorist financing of more than 60 countries assessed to date. Consequently, the integrated review of security, defence, development and foreign policy committed to take stronger action to bear down on illicit finance, including by bolstering the National Economic Crime Centre and working with our closest allies, such as the United States, to maximise our collective impact against this common threat.

The recent spending review has put new resources behind that commitment: £42 million for economic crime reform from now until 2025. That is in addition to £63 million for Companies House reform and the introduction of the economic crime (anti-money laundering) levy, which will raise around £100 million per year from the private sector, to combat economic crime from 2023. These additional resources will significantly enhance our ability to tackle transnational corruption and illicit finance.

Since 2006, the Foreign, Commonwealth and Development Office has funded the National Crime Agency’s international corruption unit, a world-renowned law enforcement capability focused on investigating corruption from developing countries with UK links. Since funding started in 2006, ICU investigations have resulted in the conviction of 30 people and companies for corruption offences. It has also frozen, confiscated or returned to developing countries more than £1.1 billion-worth of stolen assets.

In addition, the UK leads and hosts the International Anti-Corruption Coordination Centre, which brings together specialist law enforcement officers from multiple agencies around the world to tackle allegations of grand corruption. The IACCC significantly enhances our ability to investigate complex, multi-jurisdictional corruption cases. Since its launch in 2017, it has provided support on 88 investigations.

In 2019, the UK launched its economic crime plan that provides a joined-up public and private sector response to economic crime. The success of our public-private partnership is perfectly demonstrated by the work of the joint money laundering intelligence taskforce, a mechanism that enables law enforcement and the financial sector to work more closely together to detect, prevent and disrupt money laundering and economic crime. To date, the joint money laundering intelligence taskforce has helped more than 600 law enforcement investigations. This has directly contributed to over 150 arrests and the seizure of more than £34 million in illicit funds.

Finally, in April last year, the UK launched the global anti-corruption sanctions regime, which the right hon. Lady mentioned in her remarks. This allows the Government to impose asset freezes and travel bans on Toggle showing location ofColumn 573those involved in serious corruption around the world, and it sends a message that the UK will not tolerate those individuals, or their ill-gotten gains, in our country. The regime does not target countries, but instead targets those individuals or organisations that are responsible. We believe that this is a strong, personal deterrent and it has been used so far to sanction 27 individuals in 10 different countries.

Collectively, these investments significantly enhance our ability to bring corrupt actors to justice. They also send a clear message that we will use the full force of our capabilities to bear down on those who seek to use the UK as a destination for their illegitimate wealth.

Criminals, corrupt elites and individuals who threaten our security are not welcome in the UK.

Dame Margaret Hodge

Sharethis specific contribution

I am extremely grateful to the Minister, but he has given me a very general response. I named more than 20 individuals, many of whom are members of the same family. Will he undertake to investigate the circumstances that I briefly outlined, and undertake that, if I am correct, those individuals will face sanctions under the new regime?

Column 574is located here

James Cleverly

Sharethis specific contribution

The right hon. Lady will, I am sure, understand that it can sometimes be counterproductive to go into details about what future sanctions designations the UK Government might undertake, but I can absolutely assure her that my officials, and indeed the House, will have taken note of the individuals she highlighted in her speech.

In relation to Kazakhstan, or indeed any other country, our law enforcement agencies continue to monitor and, if necessary, investigate particular cases where circumstances require. We know that corruption and illicit finance can have a devastating impact on states and citizens by undermining democracy, bankrolling authoritarian agendas, and enabling serious and organised crime. The UK has shown, on the world stage, that it has both the means and the will to promote responsible financial behaviour. We have shown that we stand ready to take action, domestically and internationally, wherever necessary. I am sure you will agree, Madam Deputy Speaker, that we must now stand together to show that corruption has no place in this country.

Question put and agreed to.

Previously wrote about it https://www.parliament.uk/